Many B2B blogs lack strategic focus; wasting time, money, and opportunities to engage with target audiences. Is it time to rethink your blog?

To Win New Clients, Your B2B Firm Needs to Understand “Career Risk”

In a perfect world, the most experienced and qualified B2B firms always win the business.

But in our real world, prospects apply a very different selection factor.

Prospects will always be more concerned with the career-related risks involved in hiring any outside resource. Bluntly, they fear that if the firm they select fails, then they will pay a price.

What’s the price they can pay?

Taking the blame for a selection that wastes time, money, and opportunity can affect their career advancement, their salary & bonus, and even result in termination.

A prospect’s career risk management strategy will always be to select the “safe choice,” (usually the largest or best-known candidate) when picking an outside advisor. Qualifications are far less important.

HOW CAN YOUR FIRM AVOID BEING A VICTIM OF CAREER RISK?

To address career risk, and to win clients, your top marketing priority is to position your B2B firm as a safe choice.

Here’s what that means:

1. Creating “Credibility Tools” that provide direct or indirect 3rd party endorsements

2. Making those credibility tools highly visible and easy to find on your firm’s website

3. Providing solutions to challenges and opportunities that “safer” competitors can’t deliver

To learn how to position your B2B firm as a safe choice (and other capabilities you need to grow your business), here’s a link to a complimentary webinar.

Filed under B2B Marketing

Why Most B2B Firm PR Strategies Fail to Deliver Tangible Results

PR (or “earned media”) is the most powerful form of content marketing, because of its potential market reach, online visibility, and inherent 3rd party endorsement.

Unfortunately, most B2B firms fail to achieve a return on their PR investment, for 3 reasons:

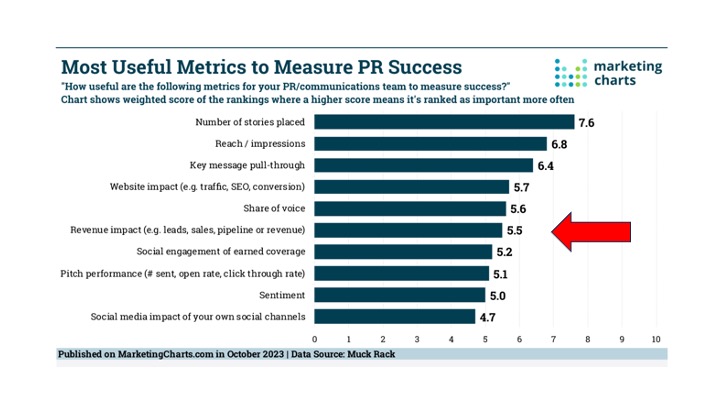

🏴 Most B2B firms are focused on the quantity, rather than the quality, of their media placements. As the chart below reflects, “Revenue Impact” ranks as only the 6th (out of 10) most important success metric. It should be the most important metric.

🏴 Most B2B firms are seeking the WRONG kind of earned media. For example: one-off quotes in news stories, pay-to-play articles in any type of publication, and pickup from most press releases are worthless. The most valuable type of earned media is bylined articles in respected business and industry trade publications that showcase your firm’s intellectual capital.

🏴 Most B2B firms don’t understand that the strategic purpose of earned media is to generate a “credibility tool” that should be used to engage with target audiences and shorten the sales cycle. Most firms simply post media placements on their social media and website like a hunting trophy…which has little practical value.

If your firm would like to learn how to improve the return on its PR investment, let us know how we can help.

Filed under Key Performance Indicators, Marketing Strategy

Client Newsletters for B2B Firms Is Content that’s Dead on Arrival

Client newsletters are one of the most widely used, and often abused marketing tactic for B2B firms of any size. Here are three myths and realities to help your firm determine whether it’s a worthwhile tool, or how to improve your current newsletter.

MYTH #1: Your B2B Firm Needs a Client Newsletter

Marketers want you to believe that your firm needs a newsletter. But traditional newsletters – containing commentary ranging from client alerts on tax legislation, to “best of” awards, or who’s joined the firm – are not a marketing necessity. In fact, at many firms their client newsletter is a marketing albatross. Each issue involves a frustrating hunt for timely information of genuine interest. Some firms avoid this pain by slapping their logo on boilerplate content purchased from a 3rd party, but those firms can pay a bigger price, in terms of brand damage. It says to target audiences, “We value our relationship, but we don’t really care enough (or know enough) to showcase our own intellectual capital in a newsletter.”

REALITY #1: Your Firm Needs to Drive Top-of-Mind Awareness

The intrinsic purpose of tactics that communicate with clients, prospects and referral sources is to reinforce the perception that your firm is smart, trustworthy and prepared to help. Beyond keeping and growing existing clients, (and because less than 5% of your target market needs your firm’s services at any time) the primary marketing goal is to drive top-of-mind awareness with target audiences. That way, when a prospect is seeking assistance, there’s a greater likelihood your at least will be put on the “short list” of candidates. If that’s the goal, then consistency and quality of the communication are critical; neither of which necessarily require a newsletter format to accomplish.

___________

MYTH #2: People Want to Learn About Your Firm’s Success

It’s nice to think that clients and prospects really care about your firm’s growth and accomplishments. The sad truth is that your firm’s success is more important to your competitors, and to current and prospective employees, than it is to your clients. Blowing your own horn can also backfire. When your firm touts that a senior partner has just published a book and was a guest on CNBC, your target audiences may wonder why that partner isn’t focused on client matters, or whether the cost of his publicity tour will result in higher hourly rates.

REALITY #2: Your Clients, Prospects and Referral Sources Care about Themselves

Understanding that all people are self-interested can make you a better marketer. Rather than creating newsletter content that’s based on what you know, on what you’ve done or on what you can do, focus instead on the ideas, talents and accomplishments of your target audiences, regardless of whether your firm played any role in their success. This is a very tough concept for many B2B firms to understand and embrace: that the most powerful form of thought leadership does not involve pushing out your own ideas. Instead, it involves deciding what ideas merit the attention of your target audiences, as well as what voices are worth listening to. True thought leaders seek to manage the conversation, not to control it.

_________

MYTH #3: A Newsletter is a Cost-Effective Marketing Tactic

The old saw, “Cheap is dear” rings true when it comes to newsletters. If it’s created in-house, few firms actually track the hours required to research, write, edit, approve and publish their newsletter. If it consists of cut & paste content, few firms consider the inherent opportunity loss in producing a newsletter that very few people will read or respect. Regardless of its content, only a small number of professional service firms proactively work to expand their newsletter’s reach, to maintain an adequate CRM capability, or to proactively leverage readership analytics from open and click-thru rates, if their newsletter is delivered online. Even fewer firms ever survey their target audiences to ask if they find the newsletter of value.

REALITY #3: Your Marketing Requires More than a One-Way Conversation

Newsletters often are one-way conversations. A fundamental marketing objective is to engage clients and prospects in a conversation regarding their specific needs and opportunities. Despite all the buzz regarding social media, that channel also falls short in terms of engagement, as most blog posts go unread. If your firm’s traditional and social media marketing tactics do not serve as catalysts to drive face-to-face discussions and word-of-mouth referrals, then their “cost-effectiveness” can never be measured on any meaningful basis.

Here’s the acid test to determine if your client newsletter has any marketing value: stop publishing it…and see how long it takes for anyone outside of the firm to ask why they haven’t received your firm’s latest issue. Chances are that no one will.

If your B2B firm is seeking to showcase its intellectual capital, and drive market engagement, the traditional “all about us” newsletter is not the most effective way to accomplish those goals.

Filed under B2B Marketing

Why Most B2B Companies Don’t Use Earned Media (Public Relations)

Most B2B company websites, across all industries, contain some combination of self-produced “owned media” content, including blog posts, case studies, white papers, podcasts, archived webinars, and event calendars. A significantly smaller number of those websites, however, contain any publicity (earned media) that showcase the company’s intellectual capital, success stories, products and services, or people.

There are 3 reasons why most B2B companies do not pursue earned media:

They fear the lack of editorial control. The intrinsic value, as well as the inherent risks, related to earned media – whether the coverage is solicited by the company, or in response to a media inquiry – is that bona fide journalists from respected media sources are expected to deliver fact-based, objective reporting and / or opinions. Despite the erosion of public trust in “fake news” (mostly related to political and world news reporting), business and industry trade media sources continue to have a high degree of credibility and influence.

Over an after-hours cocktail, most corporate clients will admit to their PR firm flack that one unspoken reason for their engagement is to serve in a risk management capacity. Simply put, if the CEO is looking for a head to roll following negative media coverage, the outside PR rep serves as a convenient scapegoat, and the CMO’s career can remain intact.

Career risk notwithstanding, many companies have legitimate concerns based on fear of being misquoted, or based on dealing with a journalist who either does not understand their business or covers the story with a preconceived agenda.

[[What these companies fail to understand: There are ways to benefit from the market exposure and inherent 3rd party endorsement of media coverage without losing control over editorial content. For example, bona fide bylined articles (not pay-to-play “native” content), authored by company subject matter experts on relevant topics, written in a non-self-serving manner, provide all the benefits of earned media without the risk of being misquoted or represented in a negative manner.]]

They don’t know how to generate positive coverage. The most valuable type of media coverage – in terms of having a positive, near- and long-term impact – is written by professional journalists associated with respected media sources. Their job is to present “balanced” coverage, which means it will most always include some information that’s considered to be negative by the company, product, or individual that’s featured in the story.

In advance of the media target research, selection, and “pitching” logistics involved in seeking a staff-written story, a company first needs to:

- Be confident that the coverage they’re seeking is of likely interest to the journalist, and based on accurate facts and tangible evidence to support the proposed story;

- Accept the fact that reporting may include some negative or contrarian information;

- Identify the most likely or “worst case” details a journalist may want to include in the story, and be prepared to address those issues; and

- Believe strongly that the net positive aspects of the coverage will far outweigh any potential negative information that’s included.

[[What these companies fail to understand: When a journalist accepts a story proposal from a company that’s done its homework – both in terms of supporting their story with facts and outcomes, and in assessing the “balanced reporting” risks – there is an extremely high likelihood that the coverage will be positive, and of benefit to the company.]]

They don’t appreciate the power of earned media. In ways that really matter for companies, notably lead generation, market engagement and revenue generation, no other type of marketing content compares with earned media exposure.

Here’s a real-life example: The business units of Travelers Group, prior to its combination with Citibank, included Travelers Insurance and Primerica; which represented two very different insurance categories and operating cultures. Travelers Insurance sold whole life coverage through full-time professional insurance agents, while Primerica sold term life insurance through its part-time sales force, consisting of teachers, fire fighters and other “blue collar” workers.

Historically, the insurance industry looked down upon term life insurance, and had low regard for part-time agents. With two very different products and cultures under its red umbrella, and with the intention to gain market share in the term life insurance market, Travelers Group set out to reposition Primerica as a legitimate insurance carrier that provided a worthwhile product to customers.

Based on significant improvements in sales practices and compliance it had instituted at Primerica, and with the expectation that any coverage would include Primerica’s prior shortcomings, Travelers Group pitched a “transformation” story to Best’s Review, one of the insurance industry’s most respected publications.

Their calculated risk paid off. Bigtime. The headline of the Best’s Review cover story read: “Primerica’s Metamorphosis: The “termites” of the life insurance industry have been reborn under the Travelers Group umbrella as financial planners to the underserved middle class.”

That article not only became the most requested reprint in the history of Best’s Review, and an important part of the sales kit used by Primerica’s part-time agents; the media coverage was also recognized as the catalyst for a significant and sustained increase in term life sales for Primerica, and as an effective tool for recruitment of new part-time agents.

[[What these companies fail to understand: Earned media is more difficult to achieve, and can involve a degree of risk, which can be managed. But in terms of return on marketing investment, and the potential to generate tangible business outcomes, no other marketing tactic comes close.]]

Filed under B2B Marketing

Why Content Marketing Will Continue to Fail in the Age of Artificial Intelligence (A.I.)

In the mid 1980s, with introduction of the Mac computer, PageMaker software, and the LaserWriter printer, the DeskTop Publishing system was born; for the first time allowing anyone to create print and online marketing materials that did not require a bona fide graphic designer or any elaborate printing hardware to produce physical documents.

This was a major technological advancement in the world of marketing communications. It also marked the beginning of a (ongoing) period that has produced some of the most incomprehensible, unattractive, and brand-damaging print and online marketing materials in the history of the communications.

DeskTop Publishing did not make people with no design talent or writing skills into graphic designers or copywriters. And based on the way content has been created and applied by most firms over the past decade, the availability of Artificial Intelligence will not make people more effective content marketers.

Here’s why:

- Most firms still don’t understand that marketing content is NOT about sales.

Blog posts or press releases extolling the features and benefits of your firm’s whiz-bang new product or service are more likely to be read by competitors than by prospects. White papers lost their credibility many years ago, because so many companies turned them into self-promotional sales brochures.

Your target audiences want objective, relevant, helpful information that addresses their challenges and opportunities, and enables them to draw their own conclusions regarding your firm’s ability to assist them.

- Most firms still don’t know how to extract or showcase their own intellectual capital.

Using ChatGPT to create a 500-word blog post may provide your company with the appearance of thought leadership, and remove some or all of the burden of drafting your own content. But AI-generated content will never be able to craft marketing content that’s based on your company’s unique experiences and perspectives that support its value proposition…which is what your clients, prospects and referral sources really want to know about.

- Most firms still create content that their target audiences don’t care about.

Your company understandably wants to demonstrate its investment in employees, or its commitment to charitable and civic causes. But in an online world where you have nanoseconds to catch market interest, content describing your company’s mud run, golf tournament, or wishing people a Happy Cat Lovers Day, is an enormous opportunity loss in terms of audience attention.

Find another platform for your internal news, and focus exclusively on addressing the “What’s In This For Me?” question that the outside world applies to all content.

Technology tools – whether it’s DeskTop Publishing or Artificial Intelligence – will never replace human (or corporate) experience, insights, talent, or creativity. Those tools are only of value in content marketing if you know how and when to apply them. The marketing profession’s track record suggest that more time should be devoted to strategy than to tactics.

Filed under Uncategorized

Three Law Firm Marketing Shortcomings…and How to Avoid Them

The generation of attorneys who still consider any type of “marketing” to be unprofessional is diminishing, concurrent with the increase of “Emeritus” partners listed on law firm websites. That evolution notwithstanding, most law firms and younger practitioners remain stuck in neutral, in terms of marketing sophistication.

Hard-wired to follow apparent industry “best practices” (mostly based on mimicking competitors), law firms of all sizes continue to miss opportunities to increase clients and revenue. But pathways for improvement are available. Adoption of a few simple marketing principles applied by successful professional services firms in other disciplines – including financial services, accounting, architecture, engineering, and management consulting – can drive consistent engagement with existing and new clients for any law firm or practitioner.

Here are three ways that law firms are missing opportunities to accomplish that goal:

Shortcoming #1: Over-Reliance on the Influence of Law Firm and Attorney Rankings

The proliferation of legal rankings combined with greater understanding of the economic self-interests of ranking providers has eroded the legitimacy of their “Super” and “Best” attorney and firm rankings, and greatly reduced the impact of rankings as a selection factor. Because these (largely “pay-to-play”) recognitions do not allow prospective clients to draw first-hand conclusions regarding a practitioner’s or firm’s ability to address their needs, they are a relatively weak and lazy marketing tactic.

Law firms and attorneys would be better served by not playing the rankings game, and investing whatever time and attention is required to create substantive content that showcases their intellectual capital in their areas of expertise, and by having that content published under their byline in respected business or industry publications. This earned media exposure generates an inherent 3rd party endorsement from an objective, credible source. In turn, these “credibility tools,” require no leap of faith regarding the practitioner’s or firm’s potential to add value. Prospective clients can judge that for themselves.

Shortcoming #2: Failure to Drive (Relevant) Top-of-Mind Awareness Among Target Audiences

Like other service-related businesses, law firms have no insight into when a client or prospect will require their services. So most law firm marketing plans are based on putting several lines in the water, and hoping something takes the bait. Practitioners and firms invest in online directories, on search engine optimization or paid search, on Google ads and even highway billboards to drive new business inquiries. At the same time, they often fail to leverage the strength of their most powerful marketing asset; by not communicating – effectively, consistently, or at all – with their established database of clients, prospects, and referral sources; ideally on a quarterly basis.

But driving top-of-mind awareness in an effective manner among established contacts does NOT mean sending them a laundry list of items about your firm’s recent wins, about its new class of summer interns, or about its charitable golf outing. Those largely self-promotional items are more appropriately communicated on social media. Direct communication is an opportunity, and an obligation, to demonstrate thought leadership and subject matter expertise (perhaps with a recap of your recently published bylined article?), and to address the most important question on the minds of all your recipients: “What’s in this for ME?”

Shortcoming #3: Not Managing the Sales Cycle by Hijacking the Buyer’s Journey

Some law firms are unwilling to directly solicit prospective clients, either for fear of appearing desperate for business, or being accused of acting unprofessionally in attempting to displace a prospect’s current law firm. But if your firm accepts the notion that business development is a game played with a hardball rather than a softball, there are effective ways to shorten the sales cycle without compromising the written and unwritten rules of law firm marketing. Notably, this involves hijacking the Buyer’s Journey.

What does that mean?

By approaching high-value, targeted prospects with well-crafted, tailored solicitations that describe a solution to a specific problem or opportunity, a law firm can:

– Demonstrate its value proposition (Create the “Awareness” Stage)

– Gain competitive advantage (Eliminate the “Decision” Stage)

– Immediately engage with prospects on a substantive basis (Initiate the “Consideration” Stage)

– Avoid competition and responding to RFPs and RFIs, and

– Earn a position on the prospect’s “short list” for future assignments

For decades, successful professional services firms have applied these same strategic marketing principles to drive consistent client and revenue growth. There’s no reason why law firms can’t benefit from these practices as well.

Filed under Marketing Strategy, Uncategorized

How to Grow Your B2B Firm by Making Every Employee a Sales Rep

Providing all employees with basic marketing and sales skills can help your B2B firm to grow and succeed. From the front desk to the corner office, “Every Employee a Sales Rep” should be fully ingrained as part of your company’s operating culture.

Many B2B firms – in legal, accounting, technology, financial services and consulting disciplines – employ at least one rainmaker, typically a founding member, who brings in the lion’s share of new business. But that “outside / inside guy” dynamic puts a company at risk, because rainmakers can depart unexpectedly (by choice or by ambulance), and the firm’s growth rate is always limited by their energy, motivation and availability.

More importantly, this business development model fails to leverage your firm’s “inside guys,” whose individual and collective business relationships, skills, experience and credibility should be harnessed to drive consistent revenue growth and to scale the company.

Regardless of their title, job description or capacity to work the room at a social event, every B2B firm employee should be given training, tools and ongoing support that empowers them to:

- Manage Their Personal Brand – Clients hire individuals, rather than a firm, to help them. To showcase their credentials, every client-facing employee should maintain a complete and up-to-date biographical profile on the company’s website and on LinkedIn. To expand their visibility, they should also participate in at least one activity unrelated to employment, whether that’s membership in the local chapter of a professional trade association, their daughter’s soccer team, or a fly fishing club.

- Articulate the Firm’s Value Proposition – Many employees, even at the senior level, do not have a clear understanding of what makes their firm different from the competition, and are at a loss to provide a compelling reason why someone should engage them. Every employee should know their firm’s “elevator pitch,” and be prepared to recite it whenever someone asks, “So…who do you work for?”

- Nurture Their Professional Network – Every employee has a network of current and former clients, associates in other disciplines, friends, relatives, neighbors and individuals they’ve met at conferences or social events. Business contacts are often included in the firm’s CRM system, and may receive quarterly newsletters or other communications issued by the company. But client-facing employees should also maintain direct and regular contact with their entire personal network to nurture and expand those relationships, because referrals are driven by casting a wide net.

- Drive Top-of-Mind Awareness – The marketing challenge for most B2B firms is making the short list of candidates called in for an assignment. To increase the odds of getting that call, your firm must constantly sow seeds with clients, prospects and referral sources, driving top-of-mind awareness regarding its capabilities and credentials. Employees who possess the firm’s intellectual capital should play an active role in generating relevant content that can keep the firm in play.

- Sell Intrinsically – The “inside guys” who deliver services and solutions are best prepared to demonstrate to prospects and clients your firm’s capacity to add value, which is its most powerful sales tactic. Intrinsic (or “consultative”) selling is what converts prospects to clients, and not including those practitioners in the sales process can handicap your firm’s growth potential.

- Seek Cross-Selling Opportunities – The practitioner assigned to an account is the steward of that relationship. As a trusted advisor, your employee has an in-depth understanding of their client’s current needs, as well as insight into what additional services might be of value. Based on that 360° perspective, those employees are in the strongest position to recommend new services or an expansion of existing work. But many practitioners fear this solicitation will compromise their professionalism, or put the client relationship at risk. Those obstacles to increasing account penetration should be addressed with proper tools, training, and coaching.

- Ask for Referrals – This is a tough task for most employees. However, if they’ve nurtured their network, gained confidence by learning how to cross-sell to existing clients, and have rehearsed the referral request process, then they can make this a painless routine.

“Every Employee a Sales Rep” will not be achieved simply by establishing firm-wide mandates. The program must be driven by internal disciplines – consisting of written guidelines, worksheets and in-house training – that provide employees with proper guidance, support, feedback and motivation.

Combined with a senior-level commitment to change the culture, and firm-wide acknowledgement that the transformation will be difficult, your B2B company can harness its sales and marketing potential, and reap the benefits.

Filed under B2B Marketing, Marketing Strategy

Branded Interviews: Your Pathway to “Enlightened” Thought Leadership

Traditional thought leadership – whether it’s delivered through owned media or earned media – most often involves showcasing your own ideas and opinions, those of a client, or of an individual within your organization.

From a content marketing perspective, the shortcomings of traditional thought leadership include:

- the high noise factor, caused by market competition for attention

- the perception that thought leadership is mostly self-promotional

- the sad truth that few “thought leaders” have anything interesting to say

- the challenge of producing new or interesting insights on a consistent basis, and

- the reality that your target audiences are unlikely to read your long-form commentary.

The Alternative to Traditional Thought Leadership

The underlying assumption of “Enlightened” thought leadership is that managing the conversation (on any topic) by showcasing respected, credible 3rd parties is far more effective than promoting your own, your client’s, or your company’s opinions and insights.

In other words, you must put ego aside, and acknowledge that your “internal” intellectual capital can be worth less than credible outside voices that you deem to be worth hearing, and whose message supports and validates your company’s value proposition.

This somewhat contrarian approach to thought leadership…delivered in an editorial format that we call Branded Interviews…is the most effective way for B2B companies of all types to build brand stature, and to connect the dots between marketing and sales. Hands down.

In a nutshell, Branded Interviews are:

- Interviews with recognized, respected opinion leaders with credentials related to your industry or professional discipline. They should not feature employees or clients

- Presented in a quick-reading Q&A editorial format, with 10 – 12 questions that highlight the individual’s personal and professional background, insights, and opinions

- Purely objective in nature. Guest comments should not mention or promote your business in any way

- Published on a quarterly or bi-monthly basis; distributed to clients, prospects and referrals sources; and promoted on LinkedIn…ensuring top-of-mind awareness with target audiences

- Valuable due diligence assets for your sales team to use with prospects

- Inherent 3rd party endorsements that should be archived in a dedicated section on your website

In truth, Branded Interviews require considerably more time and effort than traditional thought leadership content, even compared with what’s involved in generating bylined articles in respected business publications. The strategic selection and solicitation of guests, the development of relevant questions, the interview logistics, the conversion of an interview transcript to concise written responses, and the approval process, all take time and finesse. But the end-product is well worth all that work; producing evergreen content with unmatched credibility, and countless marketing and sales applications.

It’s Not About the Content. It’s About the Relationships.

Perhaps the most compelling reason to convert to enlightened thought leadership is that the publication development process itself has tangible value, in terms of establishing and building relationships with influential individuals who can make things happen for your company.

For one of our clients – an emerging healthcare technology company – their Branded Interview led to a relationship between the firm’s CEO and the interview guest that resulted in acquisition of the company at a significant multiple, which was the CEO’s intended exit strategy.

Asking a recognized opinion leader (that your firm may have no connections with) to be profiled in your Branded Interview may seem like a long shot, as well as a formula for embarrassment if the opinion leader declines. But the invitation process serves to put your company on his / her radar screen, and is flattering to the individual, whether or not they accept. Very often, high profile individuals do accept invitations to be interviewed simply because, like most people, they enjoy telling their story, and sharing their ideas.

In our view, Branded Interviews are an important and cost-effective way for B2B companies to get noticed and build brand stature, and should be a core tactical component in an integrated marketing strategy.

Before initiating a Branded Interview program, however, there are two important caveats:

- This is not a short-term marketing tactic designed to produce an immediate market response. It’s a sophisticated, longer-term approach that will yield tangible marketing and sales benefits over time.

- Lacking a senior management commitment to produce at least four Branded Interviews over the course of a year, B2B firms should pass on this marketing tactic.

Give me a call if you’d like to learn more reasons why we’re such big fans of Branded Interviews.

Filed under Uncategorized

4 Media Relations Lessons…Learned the Hard Way

Media relations (or press relations) involves risks and consequences that can quickly derail any career, either as a corporate executive or PR agency rep. A misquote can sink a company’s stock price. An innocent “puff piece” can turn out to be an exposé that embarrasses your CEO. An insensitive comment on camera can spark a customer boycott.

Over the course of my career – as an in-house staff member, and as a PR flack for hire – I’ve received several permanent scars, while attempting to generate positive coverage, and while defending against negative reporting. Some of those media scars have been self-inflicted; others were caused by journalists who often play by their own set of rules.

Here are four lessons I’ve learned from working with the press:

1. A Reporter Can Never Be a Trusted Friend.

As spokesperson for the Options Division of the American Stock Exchange, I frequently spoke with a Chicago Sun-Times reporter who covered news related to the Chicago Board Options Exchange. At that time, the CBOE had a significantly greater number of options listings compared with the Amex, but a small number of listings were traded on both exchanges. He considered the competition for market share involving those few listings to be newsworthy.

Our weekly conversations were always friendly. Discussion topics ranged from baseball to poetry, and always ended with him asking me for a comment about market share, with me declining. After several months of weekly conversations, and having exchanged college exploits and family details, I considered this reporter a friend. Tired of declining to comment on his market share issue so many times, I finally said to him one day, “Why do you keep asking me that same dumb question? The CBOE is so much larger than the Amex, and the CBOE only trades options, so why is that a story?” He laughed and we hung up.

The next day, I was summoned to the Amex President’s office. He threw a copy of the Chicago Sun-Times in my lap. The headline of the business section read: AMEX OFFICIAL ADMITS CBOE SUPERIORITY. I expected to be fired on the spot, but instead (and to my great relief) he told me, “Don’t ever let that happen again.” I’ve never forgotten the lesson to always expect to see whatever you say (and sometimes things you didn’t say) in print. Nor have I forgotten my boss’s benevolence.

2. Some Reporters Have Personal Agendas

While representing a major chain of food stores as outside PR counsel, I brought in a Forbes reporter in hopes of having her write a company profile. The food chain had been doing very well, had an interesting story, and there was no negative news associated with the company. The reporter’s 2-hour interview with the CEO went very well. He answered all of her questions in a direct manner, and she did not present any questions that suggested an intention to write anything other than a positive story. The CEO winked at me on the way out the door, as if to say, “Nice job.”

Two weeks later, I picked up the phone, and the CEO screamed, “Have you seen the article in Forbes?” I said no, and he yelled, “When you read it, you’ll know why you’re fired!” He slammed down the phone.

I scrambled to get a copy of Forbes, and read what was a total hatchet job. The reporter had nothing positive to say about my client’s company. My fingers trembled with anger as I dialed the reporter. She picked up, and I asked her, “How could you possible write that story?” There was a long pause, then she said, “I didn’t like the way your client treated his secretary.” Then she hung up. That experience taught me that you can never count on positive coverage. Press relations is always a crap shoot.

3. Admit When You Don’t Know the Answer

As head of public relations at a very large financial services company, I spoke on a regular basis with seasoned journalists who always knew far more than I did about complex, arcane topics. I received a call one day from a Wall Street Journal reporter regarding a press release we had just issued involving a stock split. He asked me a question that I didn’t really understand, but my ego did not allow me to admit to him that I didn’t know the correct answer. His question was simple, requiring me to select one of two possible responses. Playing the odds, I picked one, hoping it was correct.

The next morning, in a flashback from my Amex days, the firm’s CEO walked into my office with a copy of the Wall Street Journal, asking who had spoken with the reporter who covered the stock split. I had picked the wrong response to the reporter’s question, and the error had been published. For a second time, I was lucky to keep my job, but groveled in the follow-up call to the reporter, asking for a clarification in the next issue. I’ve never made that same mistake, and now consider admission of ignorance a badge of courage.

4. A Reporter’s Ego Can Derail Fair Coverage

While representing a new advertising agency, I arranged an interview for the agency co-founders with a well-known New York Times columnist who covered their industry. My clients were elated at the prospect of being featured in such a respected, widely read column. But when the story appeared, some of the key facts regarding the agency were reported incorrectly.

I assured my clients that the columnist would print a clarification in his next column. I called him, and introduced myself, to which he responded, “I know why you’re calling me. And if you push for a clarification, I will never cover your client in my column again.” Offsetting this unpleasant incident, I’ve also had experiences with well-known journalists, including Dan Rather, who’ve kept their positions and egos from affecting their professionalism.

In media relations you learn to expect surprises, and to roll with the punches. Career risk notwithstanding, you have the potential to educate target audiences, to shape opinion, and to create positive outcomes for your company or client. When those good things happen, the hard lessons you’ve learned and the scars you accumulated all seem worthwhile.

Filed under Uncategorized